Features

Great rates + flexible financing options = car buying satisfaction. At Jolt, you'll get:

- Simple application and timely decisions so you can focus on the more important things in your life

- 100% financing loan to value

- No payment for 90 days*

- Payment options. Choose from automatic withdrawal, bill pay or coupon payment.

- Pay off your loan on your terms - up to 84 months.

- Low cost Guaranteed Auto Protection Plus (GAP) and Jolt Payment Protection

- Already driving your dream? Refinancing could save you money.

*Credit approval required. Interest accrues from date loan is funded.

DEALER DIRECT FINANCING

When you purchase your new or used vehicle at a participating dealership, you can finance your vehicle through Jolt and complete your transaction on the spot. All of the paperwork is taken care of at the dealership. You enjoy the same great rates without an additional trip to your local branch.

SPEED UP YOUR LOAN APPROVAL

Save trips to the credit union, limit the need for follow up and get a faster response to your application request. Gather and provide the following documents when you apply for your auto loan:

- Recent paystub, (For self-employed individuals, a W2 and/or filed and signed tax returns are required)

- Title (if refinancing your current vehicle)

- Proof of insurance

Rates

| New Auto Loan Rates | ||

| Effective Date: Saturday, April 27th, 2024 | ||

| Loan Term \ Details | Year of Vehicle | APR* as low as |

| Up to 36 Months | 2022-2024 | 7.25% |

| 37 to 48 Months | 2022-2024 | 7.25% |

| 49 to 60 Months | 2022-2024 | 7.25% |

| 61 to 72 Months | 2022-2024 | 7.49% |

| 73 to 84 Months (Minimum $10,000 Loan) |

2022-2024 | 7.99% |

| *APR=Annual Percentage Rate. Rates listed represent our best rates and include a $35.00 processing fee. Rates, terms and conditions vary based on creditworthiness, qualifications and collateral conditions. All loans are subject to approval and rates are subject to change without notice. Other conditions may apply. To view Payment Examples please select the hyperlinks on each loan rate. | ||

| Used Auto Loan Rates | ||

| Effective Date: Saturday, April 27th, 2024 | ||

| Loan Term \ Details | Year of Vehicle | APR* as low as |

| Up to 36 Months | 2013 & Older | 7.25% |

| 37 to 48 Months | 2013 & Newer | 7.25% |

| 49 to 60 Months | 2016 & Newer | 7.25% |

| 61 to 66 Months | 2017 & Newer | 7.49% |

| 61 to 72 Months | 2018 & Newer | 7.49% |

| 73 to 84 Months | 2020 & Newer | 7.99% |

| *APR=Annual Percentage Rate. Rates listed represent our best rates and include a $35.00 processing fee. Rates, terms and conditions vary based on creditworthiness, qualifications and collateral conditions. All loans are subject to approval and rates are subject to change without notice. Other conditions may apply. To view Payment Examples please select the hyperlinks on each loan rate. | ||

Payment Protection

GAP Plus

*Not NCUA/NCUSIF Insured

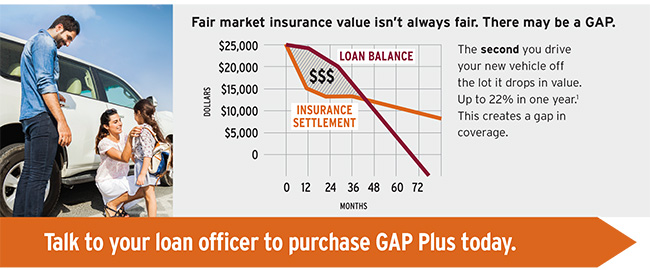

A wrecked vehicle can wreck your finances if you owe more on your loan than your insurance will pay. GAP Plus is like an airbag for your vehicle.

Guaranteed Asset Protection (GAP) Plus can help fill the gap between what your vehicle insurance will pay and what you owe on your loan, to cushion you against sudden out of pocket expenses if your vehicle is deemed a total loss. GAP Plus may cancel part of your next loan with your credit union, when you purchase a replacement vehicle. GAP Plus can help lighten the financial burden for you and the people you care about.

All of this coverage is available for a one-time premium of $525.00.

1% for a typical vehicle in America. Edmunds, “How long should my vehicle loan be?”, http://www.edmunds.com/ vehicle-loan/how-long-should-my-vehicle-loan-be.html March 2015.

Jolt Payment Protection

*Not NCUA/NCUSIF Insured

Life can be wonderful. But it can also get complicated when unexpected things happen. Protecting your loan balance or loan payments against death, disability, or involuntary employment could help protect your finances. This protection could cancel your loan balance or payments up to the contract maximum.

Jolt payment protection adds protection for life events such as accidental dismemberment, terminal illness, hospitalization, family medical leave, and the loss of life of a non-protected dependent. Protect your loan balance or loan payments today so your family can worry a little bit less about tomorrow.

Purchasing is voluntary and won’t affect your loan approval. It’s simple to apply. Ask your loan officer about eligibility, conditions and exclusions.*

.jpg)

*Refer to the member agreement for a full explanation of terms and conditions.

Skip a Payment

WE HELP YOU MANAGE THE UNEXPECTED

When you have an expense you didn't plan for or need extra cash for vacation, Jolt’s Skip a Payment* program lets you skip your monthly payment for a $35 processing fee on a qualifying Jolt loan. Interest will continue to accrue on your loan.

ONLINE BANKING USERS

Skip your payment now by logging into your Online Banking account and click on Services and select Skip a Payment.

I DON'T WANT TO USE ONLINE BANKING

Call the credit union at 800.798.2328 or stop by any location.

*Finance charges continue to accrue during the skipped period. Loans must be current to qualify. Please note that Mortgages, Home Equity loans, Credit Cards and Lines of Credit are not eligible. A $35 processing fee will be assessed for each skipped loan. Each loan may only be postponed twice per 12 month period and 3 consecutive payments must be made in between requested skip a payments. A skipped payment may reduce any GAP insurance claims on insured vehicles. Please consult your GAP Policy for more information.

FAQs

A. Terms range from 24 to 84 months for New and Used vehicles depending on the model year. Taking the shortest term within the payment range you can afford will maximize your savings. Sixty months, or five years, is the most common repayment term people choose.

A. Here are some safe and convenient ways to make your loan payment:

- Transfer your payment from your Jolt account through online or mobile banking

- Set up automatic transfer from your Jolt account to your loan

- Set up ACH payment – Allow Jolt to debit your account at another financial institution to automatically pay your loan amount each month. To enroll, contact Jolt at (800) 798-2328.

- Make a payment over the phone using a credit or debit card

- Mail your payment to Jolt. To find out your loan amount and payment date, please log into your online banking account.

- Drop off your loan payment at any Jolt location

Please note: to request payment coupons for your loan payment, contact the credit union at (800) 798-2328.

A. That will depend on your credit and other criteria. We’ll assign your request to one of our loan specialists who will determine the best rate. The rate we offer will depend on these variables:

- The amount of your down payment

- Your credit score and history

- Whether you are buying a new or used vehicle

- The term of repayment you choose

A. Jolt Credit Union has several financing options to meet the needs of most borrowers.

People that have a higher credit score will typically end up financing at the lowest interest rates.

However, that doesn’t mean that you can’t get a car loan with payments to fit your budget if you have less than perfect credit. The best thing to do is apply for a car loan and let us determine the best solution to meet your needs.

A. Jolt will finance a wide variety of vehicles from a first car for a teenage driver or a family friendly SUV to classic cars and brand new hot rods.

A. Yes, we offer competitive rates and terms for both.

A. The equity is the value of your car above what you owe on your auto loan. For example, if you owe $8,000, and your car is worth $12,000, then you have $4,000 equity. Equity in your car is important since it ensures that if you go to trade in or sell your car before you pay off your loan, you will not owe any money over and above the car’s current value.

A. There are a several reasons to consider refinancing with us. Lowering your interest rate is the most common reason. If rates have fallen since you got your loan, this may be a good time to consider refinancing.

Another popular reason is to lower your monthly payment. You can do this by reducing the interest rate you’re paying as mentioned above, or by extending the term of repayment. Call us at 800.798.2328, and we can determine if we can help you save!

*Current Jolt auto loans are eligible for refinancing and will be assessed a 1.5% refinance fee, minimum of $100.

A. Members can conveniently disburse a loan without stepping into a Jolt location by electronically signing (E-Sign) their loan documents via a secure site. To access e-Sign members need a valid e-mail account and a cell phone that can receive text messages.

A. Jolt offers a variety of quick application options through Online Banking, in office or over the phone by calling (800) 798-2328, or Dealer Direct at a participating area dealership.

A. Absolutely! Bring your car loan from a different financial institution to Jolt Credit Union. Stop in or give us a call to see if we can save you money. To speed up your loan approval, bring the title of your vehicle, proof of insurance and a recent paystub.

A. There are no pre-payment penalties.